45 coupon rate treasury bond

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month .

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Coupon rate treasury bond

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors en.macromicro.me › collections › 51Fed Funds Rate vs. US Treasury Yields | U.S. Treasury Bond ... Save US 10-year T-Note Auction Coupon Rate. The coupon rate is viewed as the fundamental costs of buying bonds. When auction coupon rate is low, demand for bonds could be huge, which leads to an increase in bond price. When coupon rate remains high, bond price falls. Remarks by Deputy Secretary of the Treasury Wally Adeyemo at Consensus ... As Prepared for Delivery Thank you so much, it's great to be here with you in Austin. I especially want to thank CoinDesk for inviting me here today to discuss how the Treasury Department is approaching the digital assets landscape, and the role of regulation in promoting the kind of innovation we need to maintain U.S. leadership of the global financial system. I spend a great deal of my ...

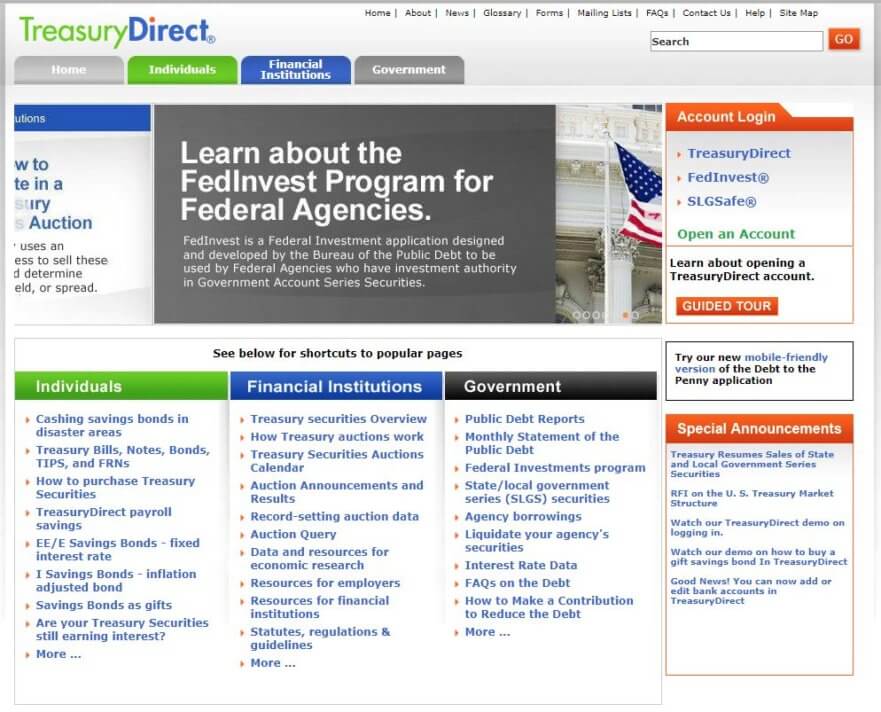

Coupon rate treasury bond. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Treasury Bond (T-Bond) - Overview, Mechanics, Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate. home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Treasury Coupon Issues The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS).

Remarks by Deputy Secretary of the Treasury Wally Adeyemo at Consensus ... As Prepared for Delivery Thank you so much, it's great to be here with you in Austin. I especially want to thank CoinDesk for inviting me here today to discuss how the Treasury Department is approaching the digital assets landscape, and the role of regulation in promoting the kind of innovation we need to maintain U.S. leadership of the global financial system. I spend a great deal of my ... en.macromicro.me › collections › 51Fed Funds Rate vs. US Treasury Yields | U.S. Treasury Bond ... Save US 10-year T-Note Auction Coupon Rate. The coupon rate is viewed as the fundamental costs of buying bonds. When auction coupon rate is low, demand for bonds could be huge, which leads to an increase in bond price. When coupon rate remains high, bond price falls. Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

Post a Comment for "45 coupon rate treasury bond"