41 are zero coupon bonds taxable

finra-markets.morningstar.com › BondCenterBonds Home - Morningstar, Inc. Sep 27, 2022 · Welcome to the Bond Section of the Market Data Center. This section includes general bond market information such as news, benchmark yields, and corporate bond market activity and performance information, descriptive data on U.S. Treasury, Agency, Corporate and Municipal Bonds, Credit Rating Information from major rating agencies, and price information with real-time transaction prices for ... Bonds - Quick Search - Morningstar, Inc. 1 päivä sitten · ALL-Show Results As Bonds Trades. CMO-Trades over $1M. WeeklyReports. MonthlyReports. Advanced Search. Enter One or More Fields. Taxes; Federal Taxable Include Exclude; State Tax-Exempt Include Exclude; Subject to AMT Include Exclude; Bank Qualified Include Exclude; Issuer / Bond Type; Rule 144A Indicator Include Exclude ...

Bonds Home - Morningstar, Inc. Welcome to the Bond Section of the Market Data Center. This section includes general bond market information such as news, benchmark yields, and corporate bond market activity and performance information, descriptive data on U.S. Treasury, Agency, Corporate and Municipal Bonds, Credit Rating Information from major rating agencies, and price information with real …

Are zero coupon bonds taxable

CUSIP Lookup and Bond Yields - Fidelity Look up over 40,000 new issue or secondary bonds, bond funds, and CDs by CUSIP with Fidelity's easy to use tool. Skip to Main Content. Site navigation. Fidelity.com Home. ... tax-sensitive) investing techniques, including tax-loss harvesting, are applied in managing certain taxable accounts on a limited basis, at the discretion of the portfolio ... Secondary Bonds Market – Types of BondsIndia You can Invest in Secondary Bonds in India. Types of Bonds in India including PSU Bonds, Corporate Bonds, Tax Free Bonds, Government Security Bonds, Zero Coupons, Convertible Bonds, Sovereign Gold Bonds, Perpetual Bonds, Green Bonds, Covered Bonds, State Development Loans, Market Linked Debenture Bonds. Understanding Bonds: The Types & Risks of Bond Investments Because bonds tend not to move in tandem with stock investments, they help provide diversification in an investor's portfolio. They also provide investors with a steady income stream, usually at a higher rate than money market investments Footnote 1. Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and …

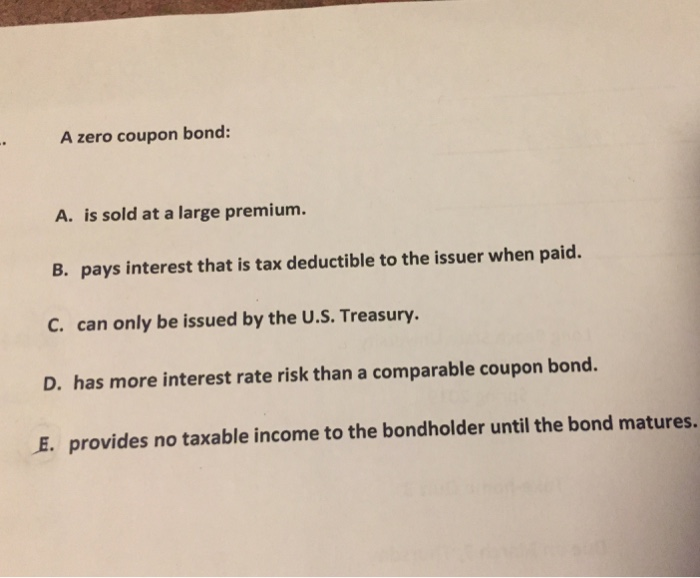

Are zero coupon bonds taxable. How to Invest in Bonds in September 2022 12.9.2022 · Where to Invest in Bonds in 2022. Many full-service brokers (Capital.com and eToro being examples) offer bonds as part of Exchange-Traded Funds (ETFs).We look at a few bond ETFs below, as they ... › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ... How Are Municipal Bonds Taxed? - Investopedia 17.1.2022 · However, most zero-coupon municipal bonds are sold in denominations of $5,000. Either way, you’re buying at a tremendous discount. This, in turn, allows you to buy more bonds if you so desire. › article › understanding-bondsUnderstanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity.

Advantages and Risks of Zero Coupon Treasury Bonds 31.1.2022 · Zero coupon bonds are bonds that do not make any interest payments until maturity, you won't put a single penny of interest in your pocket for two decades. Government Bonds India - Types, Advantages and Disadvantages … Interest earnings from such bonds are taxable under the Income Tax Act 1961 as per the investors’ applicable income tax slab. The minimum amount at which these bonds are issued is Rs. 1000 and in multiples of Rs. 1000 thereof. ... Zero-Coupon Bonds. As the name suggests, Zero-Coupon Bonds do not earn any interest. › government-bondsGovernment Bonds: Types, Benefits & How to Buy ... - BondsIndia Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction. › ask › answersHow Are Municipal Bonds Taxed? - Investopedia Jan 17, 2022 · Zero-coupon municipal bonds, which are bought at a discount because they do not make any interest or coupon payments, don’t have to be taxed. In fact, most aren't.

› knowledge › original-issueOriginal Issue Discount (OID): Formula and Calculator Generally, there are two types of bonds with an OID: Zero-Coupon Bonds: In most cases, bonds that pay zero interest are issued at an OID so that the amount that would have hypothetically been paid out as interest is received at maturity, i.e. the OID in zero-coupon bonds capture the excess of the redemption price over the issuance price. › bondsSecondary Bonds Market – Types of BondsIndia You can Invest in Secondary Bonds in India. Types of Bonds in India including PSU Bonds, Corporate Bonds, Tax Free Bonds, Government Security Bonds, Zero Coupons, Convertible Bonds, Sovereign Gold Bonds, Perpetual Bonds, Green Bonds, Covered Bonds, State Development Loans, Market Linked Debenture Bonds. Government Bonds: Types, Benefits & How to Buy Government Bonds Interest earnings from GOI savings bonds are taxable according to the Income Tax Act 1961 under the purview of the investor s income tax slab. 7.75% GOI Savings Bonds ... The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing ... Understanding Bonds: The Types & Risks of Bond Investments Because bonds tend not to move in tandem with stock investments, they help provide diversification in an investor's portfolio. They also provide investors with a steady income stream, usually at a higher rate than money market investments Footnote 1. Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and …

Secondary Bonds Market – Types of BondsIndia You can Invest in Secondary Bonds in India. Types of Bonds in India including PSU Bonds, Corporate Bonds, Tax Free Bonds, Government Security Bonds, Zero Coupons, Convertible Bonds, Sovereign Gold Bonds, Perpetual Bonds, Green Bonds, Covered Bonds, State Development Loans, Market Linked Debenture Bonds.

CUSIP Lookup and Bond Yields - Fidelity Look up over 40,000 new issue or secondary bonds, bond funds, and CDs by CUSIP with Fidelity's easy to use tool. Skip to Main Content. Site navigation. Fidelity.com Home. ... tax-sensitive) investing techniques, including tax-loss harvesting, are applied in managing certain taxable accounts on a limited basis, at the discretion of the portfolio ...

Post a Comment for "41 are zero coupon bonds taxable"