45 current yield coupon rate

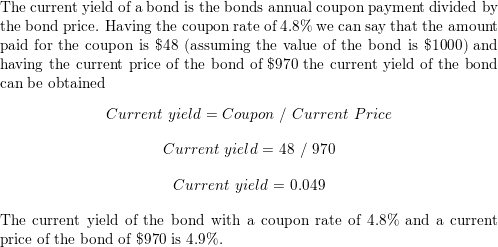

› terms › cCurrent Yield - Investopedia Oct 30, 2020 · Current yield is an investment's annual income (interest or dividends) divided by the current price of the security. This measure looks at the current price of a bond instead of its face value ... en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia Example. The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 (clean; not including accrued interest) (P) is calculated as follows.

assignmentessays.comAssignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

Current yield coupon rate

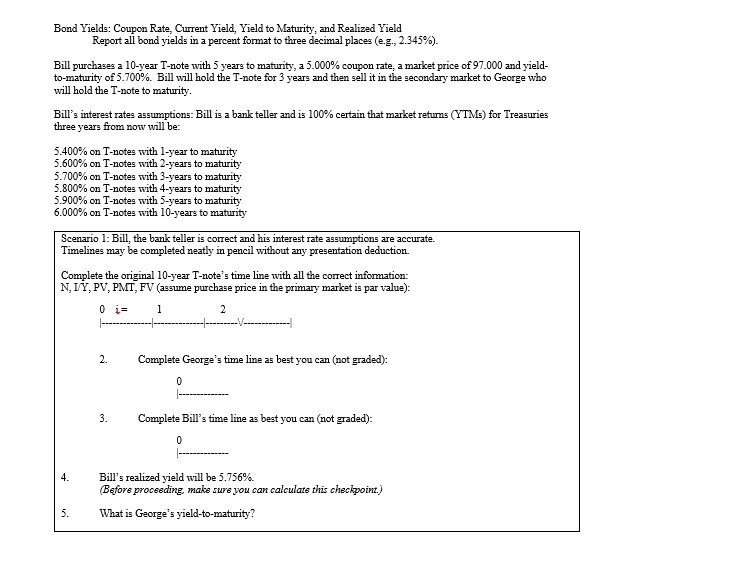

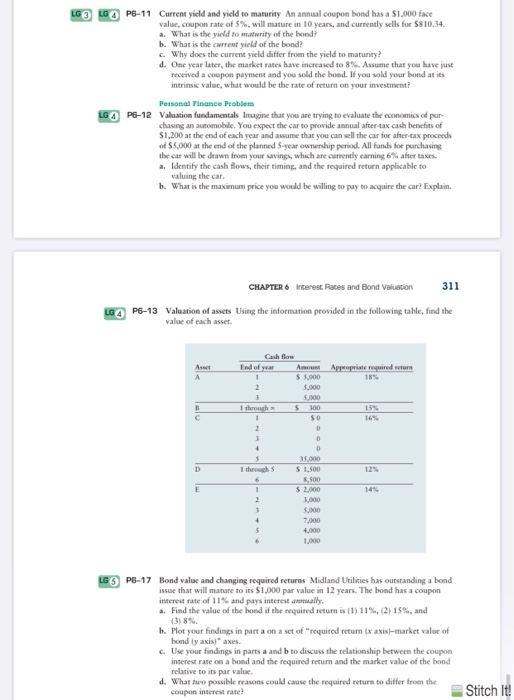

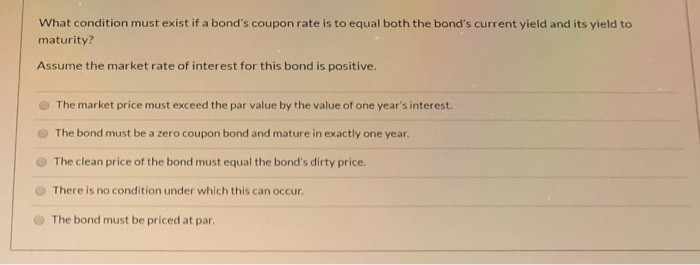

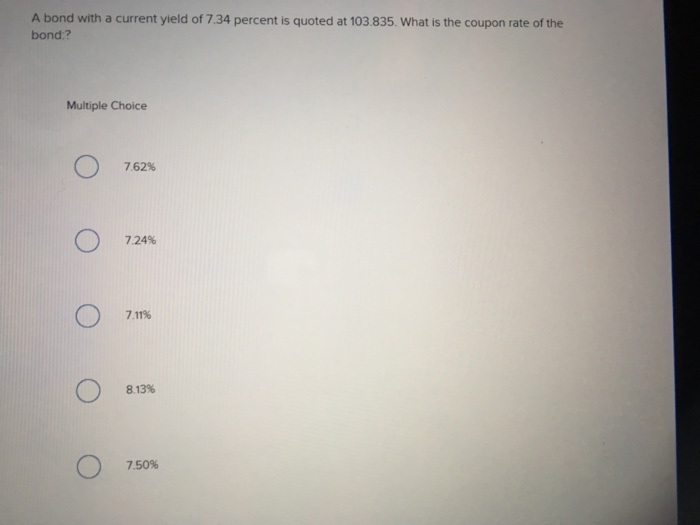

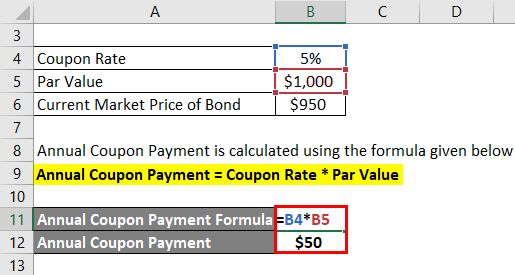

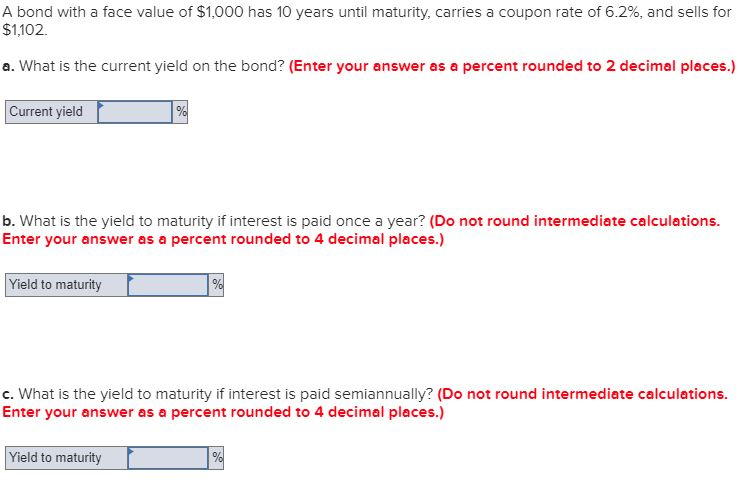

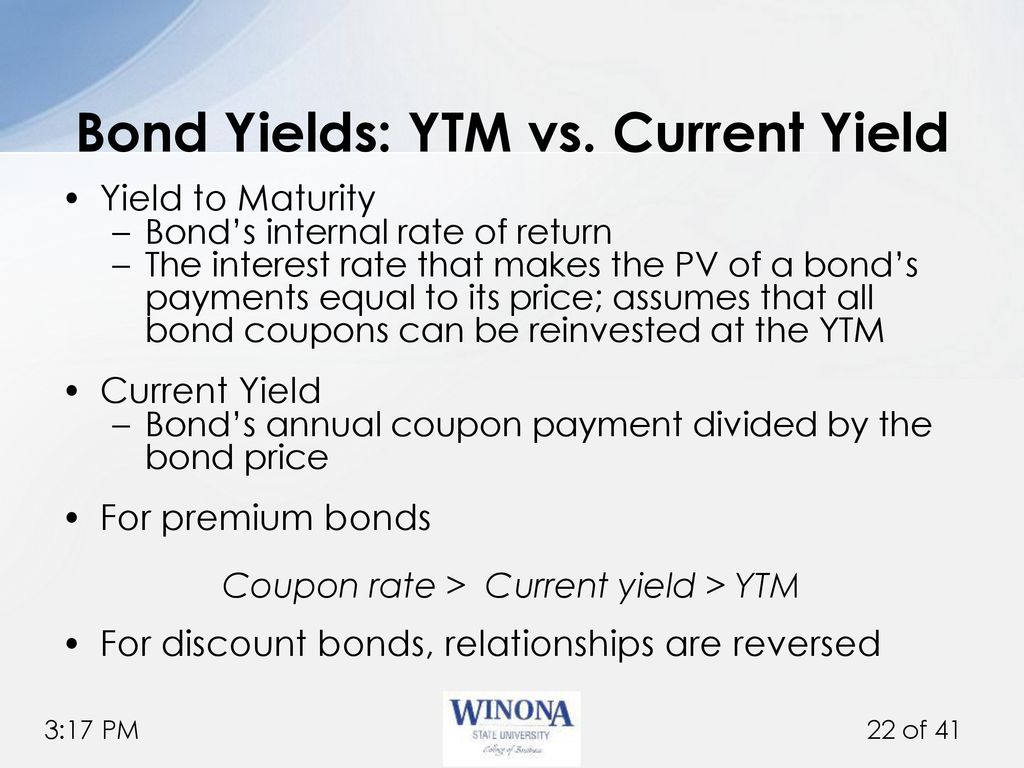

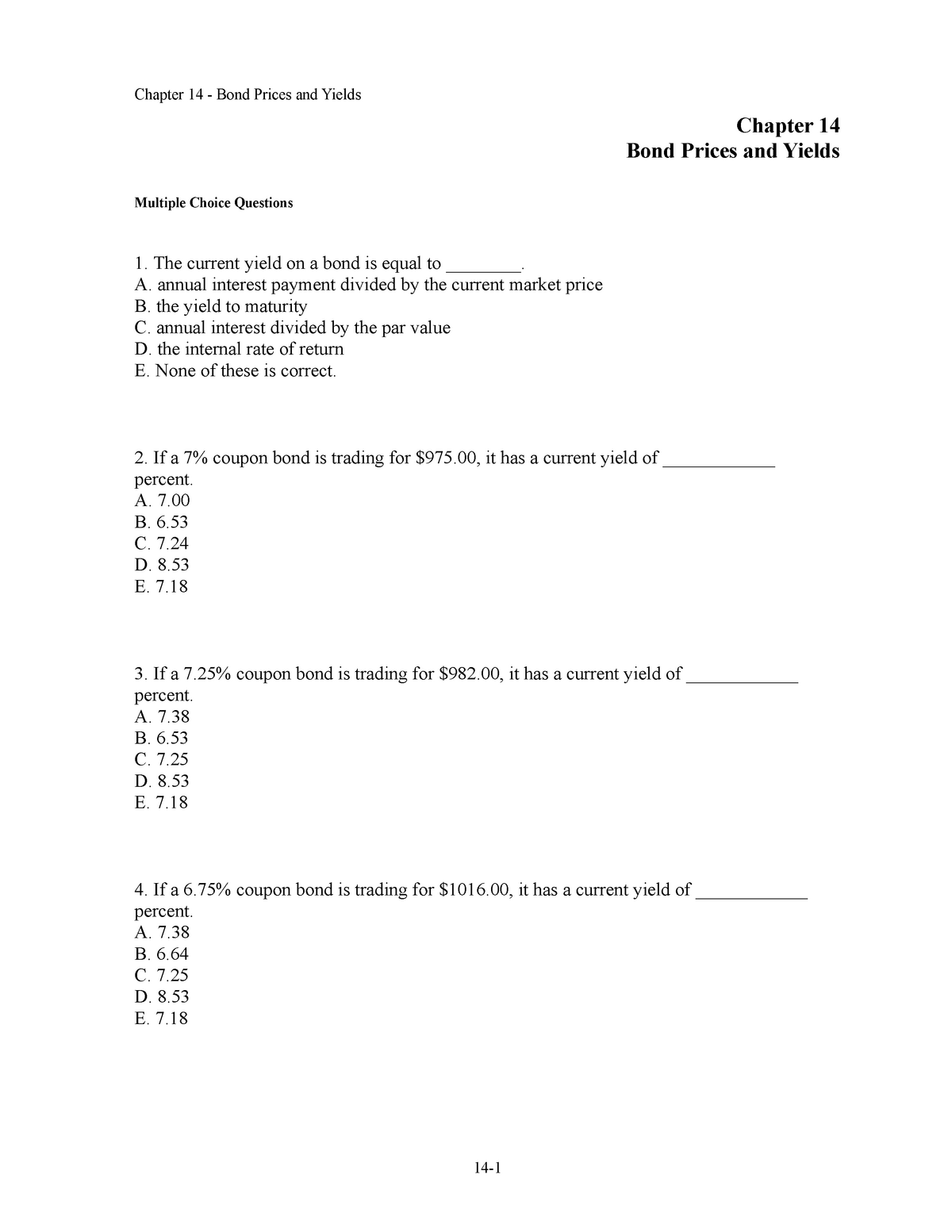

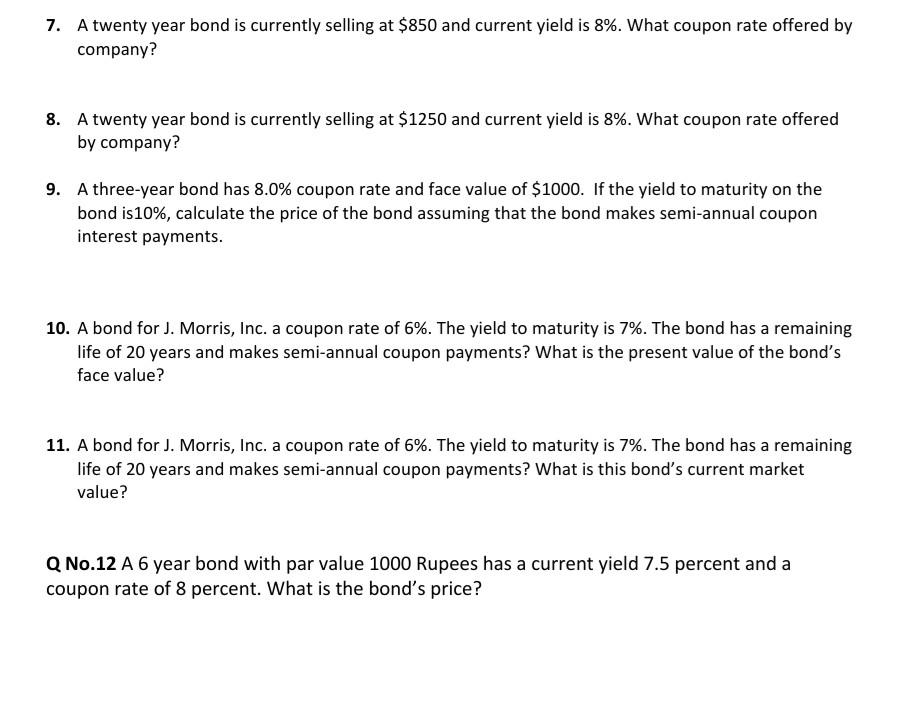

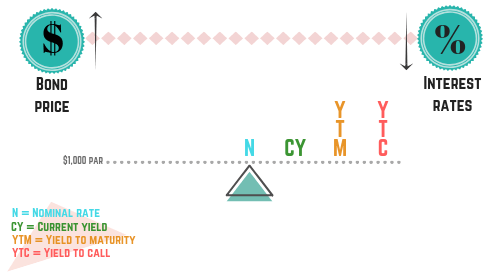

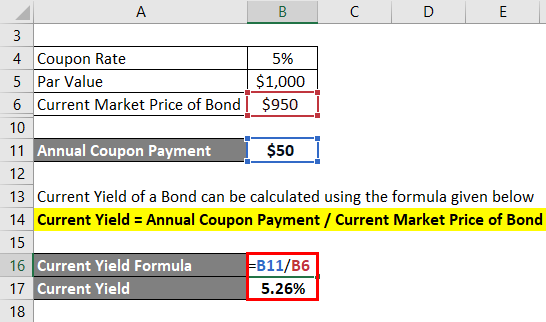

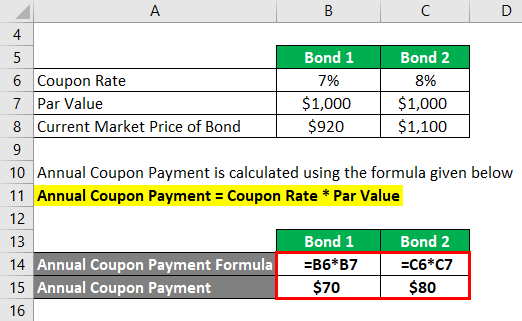

› current-yield-formulaCurrent Yield Formula | Calculator (Examples with Excel Template) Current Yield = Annual Coupon Payment / Current Market Price of Bond * 100% Relevance and Use of Current Yield of Bond Formula From the perspective of a bond investor, it is important to understand the concept of current yield because it helps in the assessment of the expected rate of return from a bond currently. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... › ask › answersCurrent Yield vs. Yield to Maturity - Investopedia Oct 07, 2022 · Bond Yield as a Function of Price . When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate.Conversely, when a bond ...

Current yield coupon rate. home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury Sep 30, 2010 · NOTICE: See Developer Notice on February 2022 changes to XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are ... › ask › answersCurrent Yield vs. Yield to Maturity - Investopedia Oct 07, 2022 · Bond Yield as a Function of Price . When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate.Conversely, when a bond ... › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... › current-yield-formulaCurrent Yield Formula | Calculator (Examples with Excel Template) Current Yield = Annual Coupon Payment / Current Market Price of Bond * 100% Relevance and Use of Current Yield of Bond Formula From the perspective of a bond investor, it is important to understand the concept of current yield because it helps in the assessment of the expected rate of return from a bond currently.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Post a Comment for "45 current yield coupon rate"