44 zero coupon bonds tax

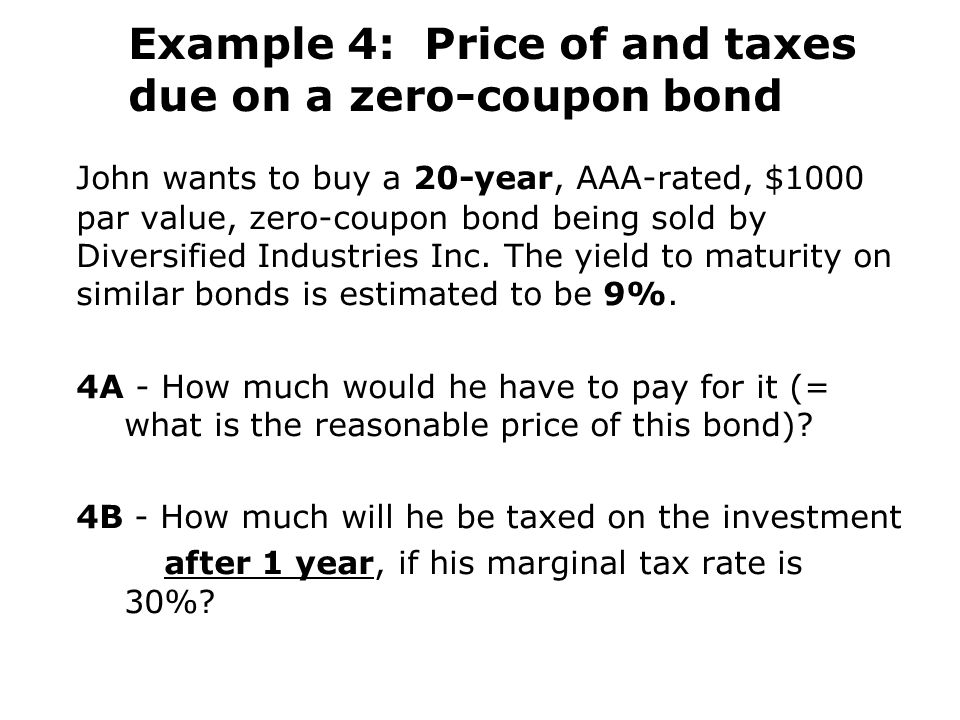

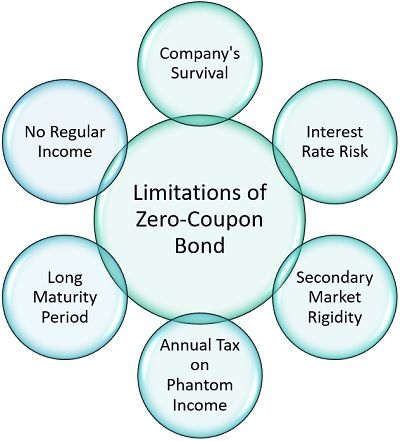

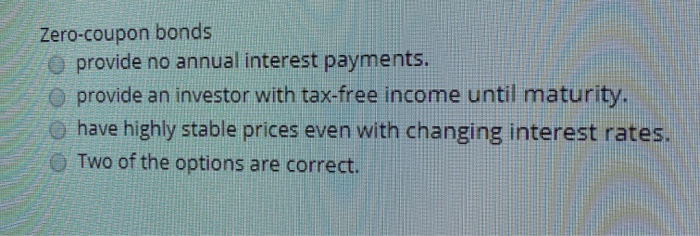

Zero-coupon bond - Wikipedia Therefore, zero coupon bonds subject to US taxation should generally be held in tax-deferred retirement accounts, to avoid taxes being paid on future income. Alternatively, when a zero coupon bond issued by a US state or local government entity is purchased, the imputed interest is free of U.S. federal taxes and, in most cases, state and local taxes. Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31/05/2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ In the United States, you need to impute the interest for some zero coupon bonds to pay taxes in the current year (possibly also for state or local taxes). One tax workaround is to purchase zero coupon bonds in tax-free accounts such as IRAs, or to purchase zero coupon municipal bonds with no tax obligations. Consult your tax advisor for a full ...

Zero coupon bonds tax

Zero-Coupon Bonds: Characteristics and Calculation Example Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula The One-Minute Guide to Zero Coupon Bonds | FINRA.org 20/10/2022 · Most bonds make regular interest or "coupon" payments—but not zero coupon bonds. Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. For ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ...

Zero coupon bonds tax. Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org 20/10/2022 · Most bonds make regular interest or "coupon" payments—but not zero coupon bonds. Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount when the bond matures. For ... Zero-Coupon Bonds: Characteristics and Calculation Example Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "44 zero coupon bonds tax"