45 what is meant by coupon rate

› stories › memberpageLiterotica.com - Members - SZENSEI - Submissions Mar 08, 2017 · SZENSEI'S SUBMISSIONS: This page shows a list of stories and/or poems, that this author has published on Literotica. › lifestyleLifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

What Is Coupon Rate and How Do You Calculate It? - Accounting Services A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually.

What is meant by coupon rate

Coupon rate Definition & Meaning | Dictionary.com Coupon rate definition, the interest rate fixed on a coupon bond or other debt instrument. See more. Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to... exchanger listing, best rates from reliable exchangers The interface of BestChange has informative icons, showing whether the exchanger has manual exchange, whether the rate is fixed or the verification required, etc. You can also read reviews by real clients to make an informed choice. Best rates for the most popular conversion directions always in front of you

What is meant by coupon rate. What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. digital opportunities with the world’s most trusted ... Leverage our proprietary and industry-renowned methodology to develop and refine your strategy, strengthen your teams, and win new business. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Coupon Rate - What it is, Formula, & Example - Speck & Company A coupon rate is the percentage value of that cash payment relative to the face value of the bond. For example, say we had a bond with a face value of $1,000 and it paid us an annual coupon of $25. The coupon for this bond would be $25/year while the coupon rate would be $25/$1,000 or 2.5%. The coupon rate is the percentage value.

What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. Instead of periodic interest payments based on the coupon rate, the higher face value is ... What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. Coupon Rate | Definition | Finance Strategists Coupon Rate Definition A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer. Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate = (Total Annual Interest Payments / Face Value of the Bond) * 100 Let's understand couponrate calculation with the help of an example.

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... Coupon rate financial definition of Coupon rate - TheFreeDictionary.com The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons.

What Is a Coupon Rate? And How Does It Affects the Price of a Bond ... Finance. The term 'coupon' is derived from the use of actual coupons for periodic interest payment collections. The coupon rate is yield paid by fixed-income security. The coupon rate is also called coupon payment. It is the yield the bond paid on its issue date. The yield changes when the value of the bond changes.

What Is Coupon Rate and How Do You Calculate It? A bond's coupon price could be calculated by dividing the sum of the safety's annual coupon payments and dividing them by the bond's par worth. For instance, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with larger coupon rates are extra desirable for ...

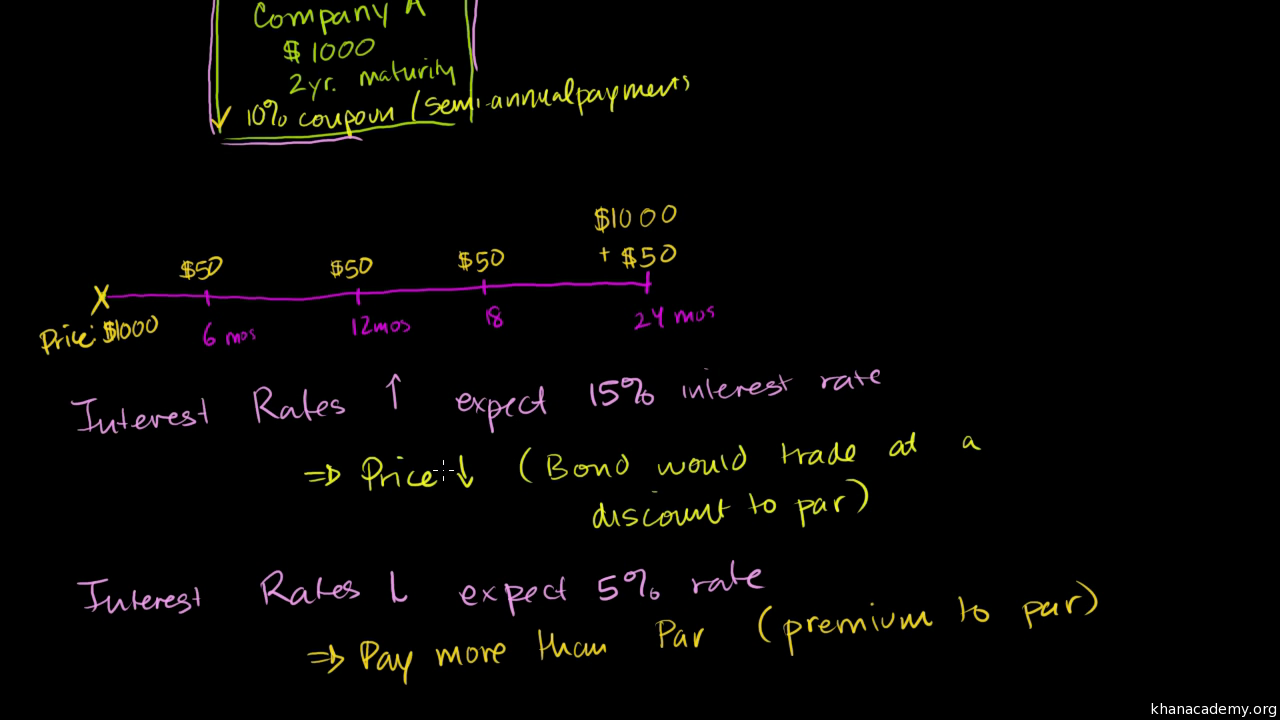

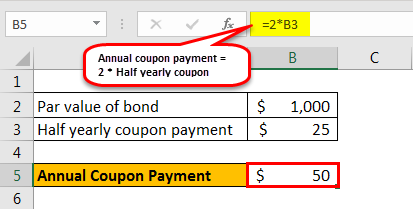

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered ...

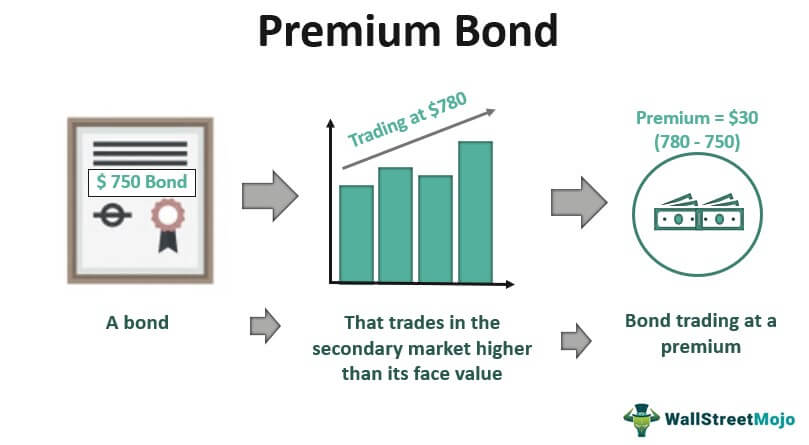

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

What are coupons in treasury bills/bonds? - Quora Treasury bonds and bills have a coupon rate. The coupon rate is the interest rate on the par value of the bond that the bondholder receives annually. Since these securities almost never sell at par, the coupon rate almost never corresponds to the return the investor will receive by Sponsored by Amanda's Gifts

What is coupon rate | Definition and Meaning | Capital.com A coupon rate is a yield that is paid out for a fixed-income security such as a government and corporate bond. A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value.

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean?

› 2022/10/19 › 23411972Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

What does Coupon Rate mean? - YouTube The coupon rate is the annual interest rate paid on a bond. It is represented as a percentage of the bond's face value. This video provides a brief explanati...

What is the Coupon Rate? - Realonomics The coupon rate is the interest payments that are made to bondholders, annually or semi-annually, as compensation for loaning the issuer a given amount of money. 6 For example, a bond with par value of $1,000 and a coupon rate of 4% will have annual coupon payments of 4% x $1,000 = $40. Where is the coupon rate on a BA II Plus?

TOP 10 what is a coupon rate BEST and NEWEST Author: Post date: 26 yesterday Rating: 5 (354 reviews) Highest rating: 3 Low rated: 3 Summary: The coupon rate is the annual income an investor can expect to receive while holding a particular bond. It is fixed when the bond is issued and is calculated by …

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and …

Coupon Rate - Explained - The Business Professor, LLC What is a Coupon Rate? A coupon rate refers to the annual interest amount that a bondholder receives usually based on the bonds face value. A coupon rate is the bond interest an issuer pays to a bondholder on its issue date. Any change in the value of the bond changes the yield, a situation that gives yield to maturity of the bond.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision What is a Coupon Rate? The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward.

› fintech › cfpb-funding-fintechU.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah.

abcnews.go.com › USU.S. News | Latest National News, Videos & Photos - ABC News ... Nov 08, 2022 · Wyoming has the highest suicide rate in the nation. ABC News’ Trevor Ault travels to the state to find out why and how the new 988 mental health crisis line might change that.

What Is a Bond Coupon, and How Is It Calculated? - Investopedia What Is a Coupon? A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are...

exchanger listing, best rates from reliable exchangers The interface of BestChange has informative icons, showing whether the exchanger has manual exchange, whether the rate is fixed or the verification required, etc. You can also read reviews by real clients to make an informed choice. Best rates for the most popular conversion directions always in front of you

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to...

Coupon rate Definition & Meaning | Dictionary.com Coupon rate definition, the interest rate fixed on a coupon bond or other debt instrument. See more.

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-interest-rate-and-annual-percentage-rate-apr-Final-3d91f544524d4139893546fc70d4513c.jpg)

:max_bytes(150000):strip_icc()/manlookingatcomputer-2368f094bfc7428b8e7b86e34186139d.jpeg)

![[OC] I compressed 30 years of US interest rate history in one minute and 22 seconds for someone at the IMF](https://external-preview.redd.it/dJmqhCjG6AQ2EwwGej3oM9ZL_N4ux_iGxHch6shncrs.png?format=pjpg&auto=webp&s=6bf6fd47fe79b4507e6beb251e424d05d6c22ec7)

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Post a Comment for "45 what is meant by coupon rate"