38 coupon rate and yield to maturity

Coupon Rate Formula | Step by Step Calculation (with Examples) For example, if a bond with a face value of $1,000 offers a coupon rate of 5%, then the bond will pay $50 to the bondholder until its maturity. The annual interest payment will remain at $50 for the entire life of the bond until its maturity date, irrespective of the rise or fall in the bond's market value. Coupon Rate - Meaning, Calculation and Importance - Scripbox The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%.

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Coupon rate and yield to maturity

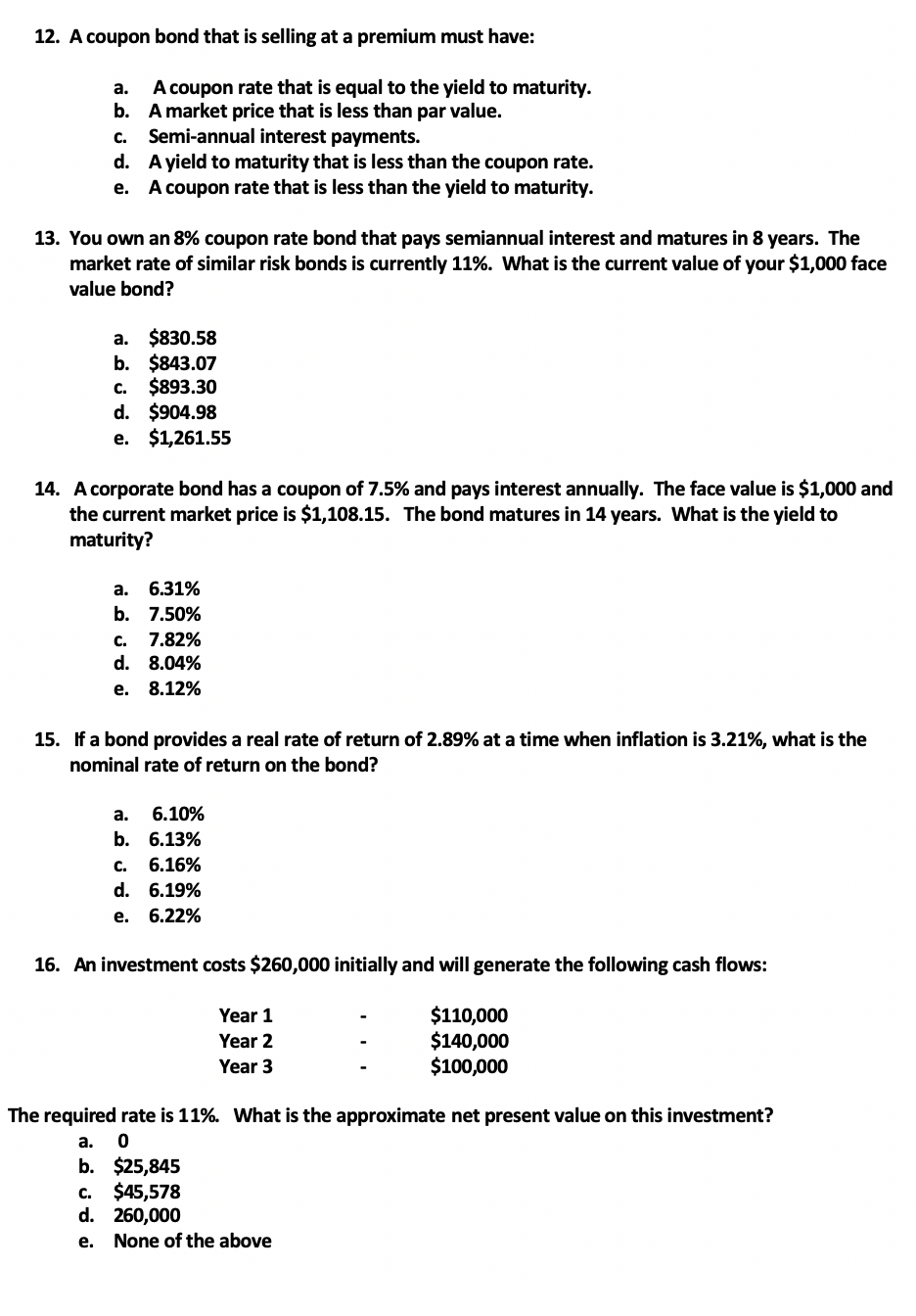

What Is the Difference Between Coupon Rate and Yield-To-Maturity ... Coupon rate is expressed as the percentage (per annum basis) of the face value of the bond. It is the amount that the bondholders will receive for holding the bond. Coupon payments are usually made semi-annually or quarterly. Yield-to-maturity (YTM), as the name states, is the rate of return that the investor/bondholder will receive, assuming ... Finance Ch 6 Flashcards | Quizlet 1 / 65. 1. What condition must exist if a bond's coupon rate is to equal both the bond's current yield and its yield to maturity? Assume the market rate of interest for this bond is positive. A. The clean price of the bond must equal the bond's dirty price. B. The bond must be a zero coupon bond and mature in exactly one year. Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is the rate of return of the entire bond cash flow, including the return of principal at the end of the bond term. Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price.

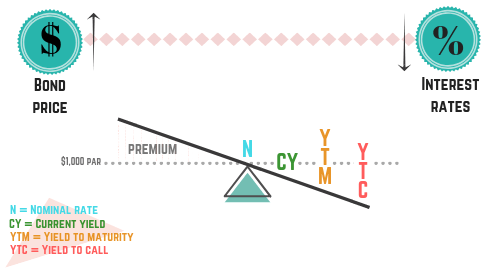

Coupon rate and yield to maturity. Current Yield vs. Yield to Maturity - Investopedia Oct 12, 2022 · Bond Yield As a Function of Price . When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate.Conversely, when a bond ... Yield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Yield To Maturity (YTM) Formula Below is the YTM formula- yield to maturity formula Where, bond price = the current price of the bond. Coupon = Multiple interests received during the investment horizon. These are reinvested back at a constant rate. Face value = The price of the bond set by the issuer. Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually. Assuming you hold the bond to maturity, you will receive 12 coupon payments of $125 each, or a total of $1,500.

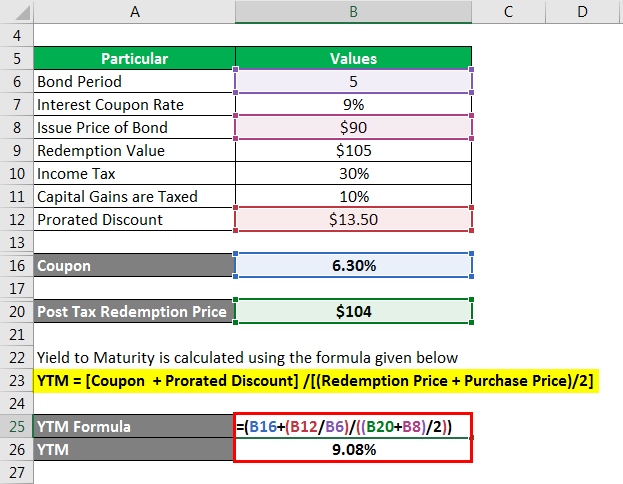

Difference between Coupon Rate And Yield To Maturity The yield to maturity (YTM) is the rate of return that an investor earns when he holds the bond till the maturity date. The YTM becomes relevant only when an investor buys a bond from the secondary market. To calculate the yield to maturity of a bond, the following formula is used. YTM = { (annual interest payment) + [ (face value - current ... Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments. r = discount rate (the yield to maturity) F = Face value of the bond. n = number of coupon payments. Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year. Bond Yield Rate vs. Coupon Rate: What's the Difference? To understand the full measure of a rate of return on a bond, check its yield to maturity. Yield Rate A bond's yield can be measured in a few different ways. The current yield...

Yield to Maturity (YTM): Formula and Bond Calculation Yield to Maturity vs. Coupon Rate and Current Yield. The yield to maturity (YTM), as mentioned earlier, is the annualized return on a debt instrument based on the total payments received from the date of initial purchase until the maturation date. When a Bond's Coupon Rate Is Equal to Yield to Maturity Jan 13, 2022 · The entire calculation takes into account the coupon rate, current price of the bond, difference between price and face value, and time until maturity. Along with the spot rate, yield to maturity ... Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return of a bond, assuming that it is... Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Yield to Maturity Calculator | Good Calculators Solution: The yearly coupon payment is $1000 × 6% = $60, the equation takes the following form: 980 = 60× (1 + r) -1 + 60× (1 + r) -2 + 60× (1 + r) -3 + 60× (1 + r) -4 + 60× (1 + r) -5 + 1000× (1 + r) -5 r = 6.48%, The Yield to Maturity (YTM) is 6.48% You may also be interested in our free Tax-Equivalent Yield Calculator Rating: 4.2 /5 (212 votes)

Difference Between Yield to Maturity and Coupon Rate The coupon rate is 5.25% with a term to maturity of 4.5 years. Yield to Maturity is calculated as, Yield to Maturity = 5.25 + (100-102.50/4.5) / (100+102.50/2) = 4.63% Yield to Maturity can be identified as an important yardstick for an investor to understand the amount of return a bond will generate at the end of the maturity period.

The Difference Between Coupon and Yield to Maturity - The Balance Yield to maturity is what the investor can expect to earn from the bond if they hold it until maturity. Do the Math Prices and yields move in opposite directions. A little math can help you further understand this concept. Let's stick with the example from above. The yield increases from 2% to 4%, which means that the bond's price must fall.

Is coupon rate the same as yield to maturity? Yield to maturity is the discount rate at which the sum of all future cash flows from the bond (coupons and principal) is equal to the current price of the bond. The YTM is often given in terms of Annual Percentage Rate (A.P.R.), but more often market convention is followed.

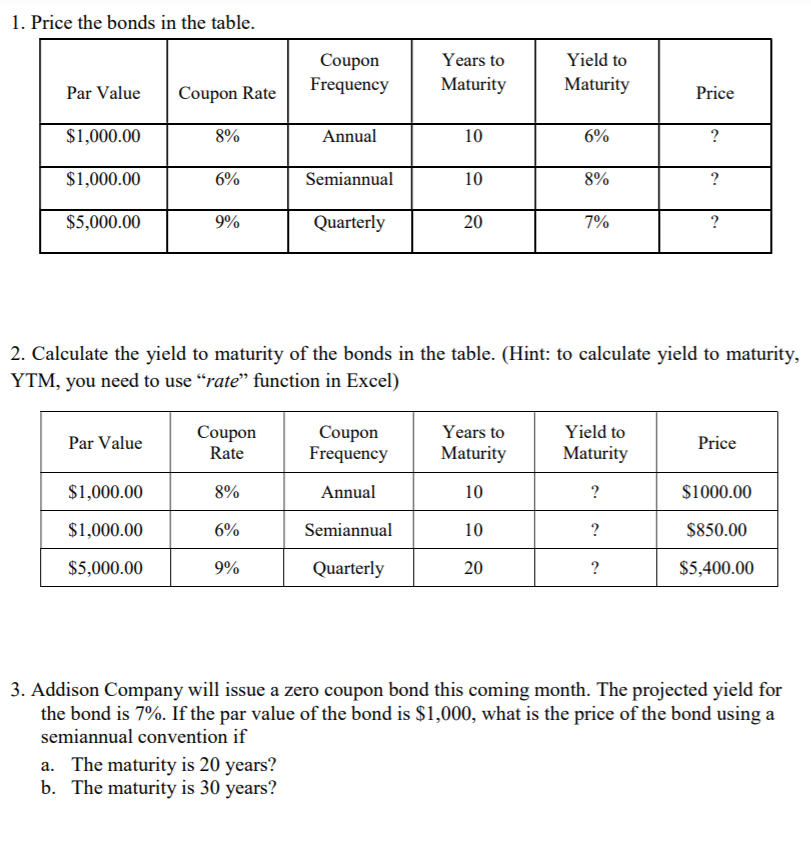

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ...

Difference Between Coupon Rate And Yield Of Maturity The rate of interest on this bond is set at 20% per annum. Here, the 10% per annum is called the coupon rate. So, when investing Rs. 20,000 in the bond, they will receive Rs. 4,000 per annum as interest payments. Yield to Maturity The yield to maturity is the return rate that investors hold while holding the bond until maturity.

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below:

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

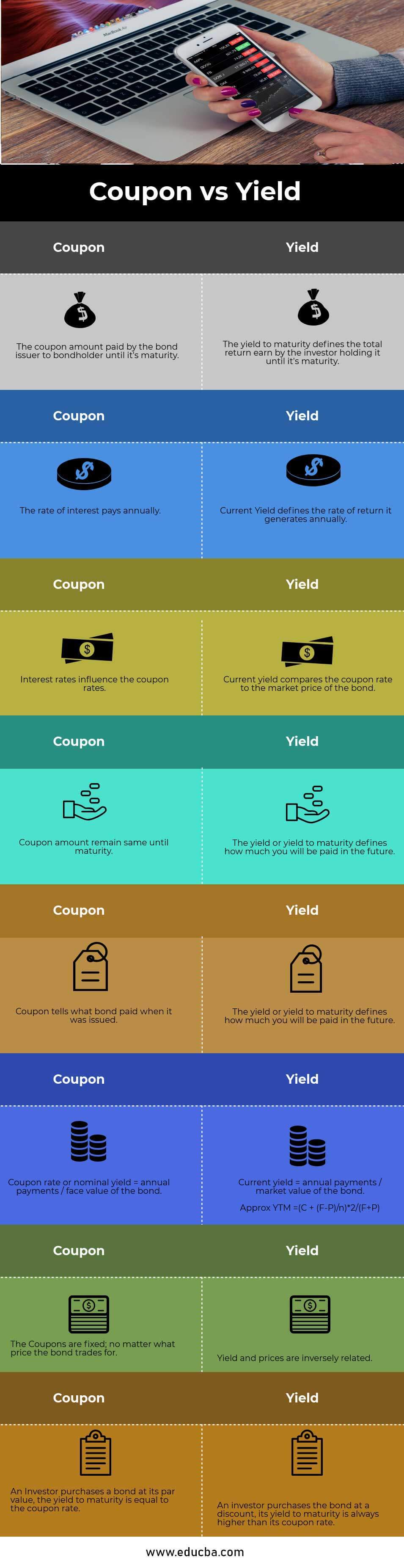

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Yield to maturity is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40. And the price of the bond is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic

Solved what relationship exists between the coupon interest - Chegg Explain. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain. (Select the best answer below.) O A. The market value of the bond approaches its par value as the time to maturity declines. The yield-to-maturity approaches the coupon interest rate as the time to ...

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Yield to Maturity Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns. As discussed, a coupon rate is a fairly straightforward rate that measures the percentage of interest rate that an investor will receive periodically from the bond issuer.

Solved The yield to maturity of a $1,000 bond with a | Chegg.com You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer. The yield to maturity of a $1,000 bond with a 7.1% coupon rate, semiannual coupons, and two years to maturity is 7.9% APR, compounded semiannually. What is its price?

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is the rate of return of the entire bond cash flow, including the return of principal at the end of the bond term. Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price.

Finance Ch 6 Flashcards | Quizlet 1 / 65. 1. What condition must exist if a bond's coupon rate is to equal both the bond's current yield and its yield to maturity? Assume the market rate of interest for this bond is positive. A. The clean price of the bond must equal the bond's dirty price. B. The bond must be a zero coupon bond and mature in exactly one year.

What Is the Difference Between Coupon Rate and Yield-To-Maturity ... Coupon rate is expressed as the percentage (per annum basis) of the face value of the bond. It is the amount that the bondholders will receive for holding the bond. Coupon payments are usually made semi-annually or quarterly. Yield-to-maturity (YTM), as the name states, is the rate of return that the investor/bondholder will receive, assuming ...

:max_bytes(150000):strip_icc()/female-executive-talking-to-colleagues-117455512-5750d4d75f9b5892e8b3d3af.jpg)

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

Post a Comment for "38 coupon rate and yield to maturity"